What You Need to Know

Earning points and miles is the best way to fly more for less. It’s the way I’ve been able to stay on the road for so long — and I’ve seen what a difference it’s made for my readers too.

I write a lot about the best credit cards to get depending on your travel goals, but I’ve talked less about how to use those points.

Today, I want to change that because I keep getting emails from people talking about how it takes too many points to book a flight. When I follow up, it is because they are booking through the credit card’s travel portal and that’s something you should rarely, if ever, do!

Travel rewards cards offer two main ways to use the points that you earn to book trips:

- By transferring points to their travel partners

- By using a card issuer’s booking portal

For those who are new to earning and using points and miles, there’s a lot of confusion about which is the better option. Travel credit cards position their portals as the best option for using your points. But, in reality, they rarely ever are.

So let’s talk about why this is.

The Low-Down on Travel Portals

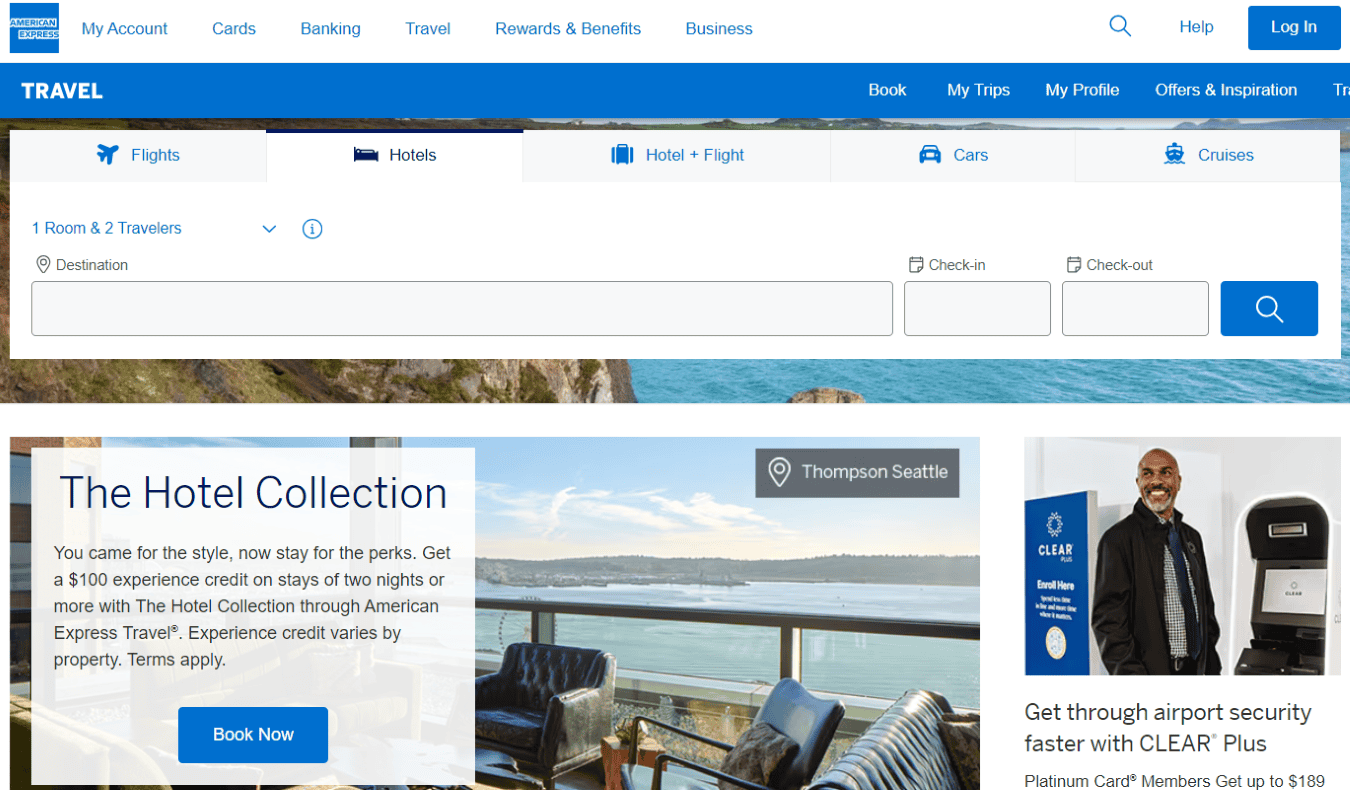

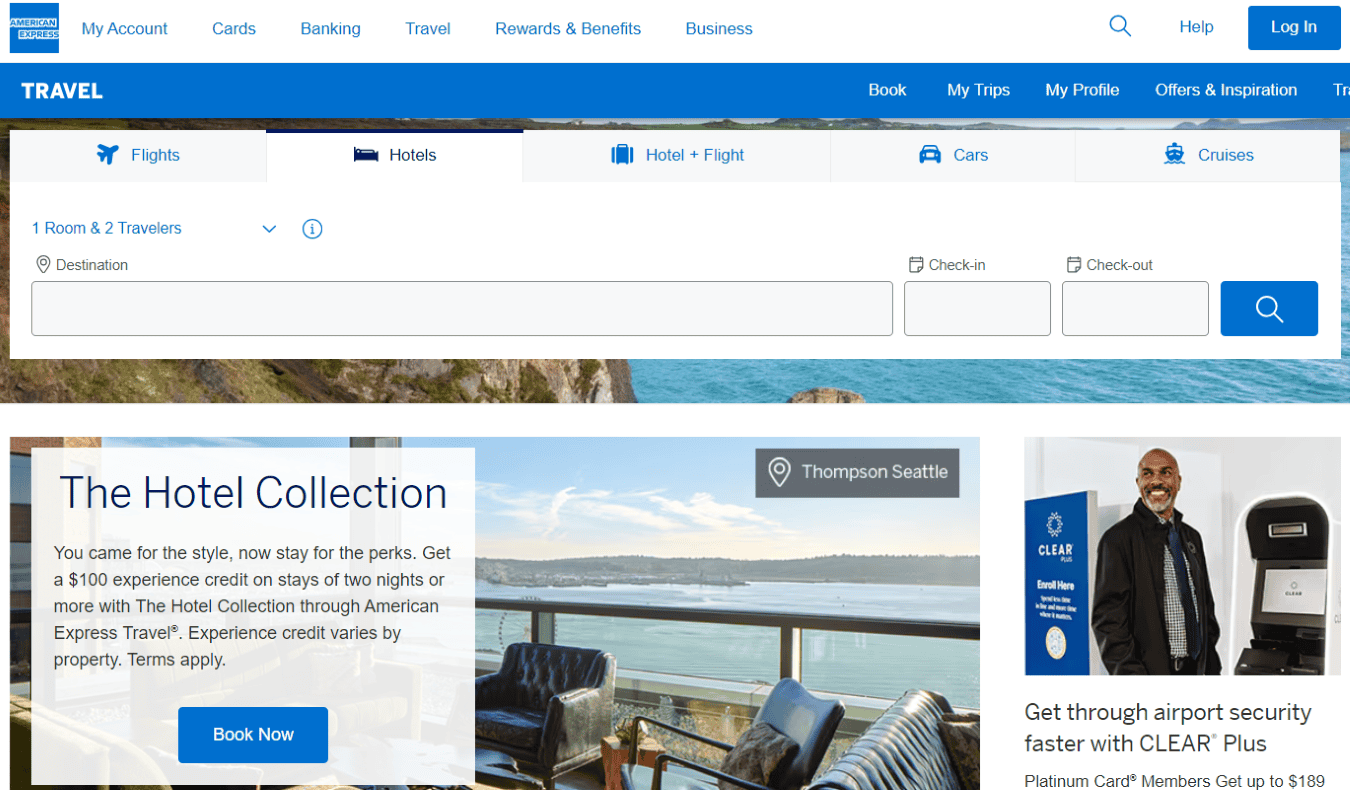

Travel portals are online travel agencies (OTAs) offered by banks as part of the benefits of holding one of their rewards cards. They work exactly like other OTAs, such as Expedia or Kayak, where you can book flights, hotels, and rental cars by searching for availability via their search engine.

The main difference is that these travel portals are connected to your credit card. This allows you to use your points and miles when booking. You can also choose to pay partially with points and partially with cash.

Using travel portals is basically like using your points as cash back. You get a fixed value per point and you will also earn points/miles on your booking.

Credit card companies position their portals as the best way to use points. They want you to use the portals and stay within their ecosystem so that they can make money off of you.

To keep you on their site, they offer incentives that you can only get when using their portal. These incentives include the following:

- Travel credits – If you use the portal, many cards offer statement credits to offset your purchase. For example, the card_name offers $50 USD hotel credit when booking through Chase TravelSM, and the card_name offers a $300 USD annual credit for bookings through Capital One Travel.

- Increased rewards earning power – You’ll earn extra points when using the portal. For example, the Capital One Venture X and the card_name cards both offer 10x on hotels and rental cars and 5x on flights when booked through their portals.

- Increased point value – You’ll get a small boost in the number of points/miles you can cash in just by using the portal. For holders of Chase Sapphire cards, for example, 1 point becomes 1.25 or 1.5 points (with the Chase Sapphire Preferred or the Chase Sapphire Reserve, respectively) when booking through the portal. (While that seems like a great deal, you can usually get a much better value per point when transferring to travel partners, as I’ll get into below.)

Travel portals are easy and convenient. However, using them is usually not the best value for your points. What you get in simplicity and convenience you lose in the fixed redemption value that usually isn’t the best.

The Low-Down on Transfer Partners

On the flip side, you can transfer points from your account directly to the place where you want to book (such as an airline or hotel). While transferring your points to travel partners is a bit more work, you can get much more value out of your hard-earned points this way.

Only certain cards earn you transferable points though. For example, airline- and hotel-specific cards (such as the card_name or the card_name) only earn you points that can be used at that airline or hotel. They’re less valuable, because they’re less flexible. Transferable points are valuable (and what you should aim to get), because they’re so flexible.

Here are a few types of transferable currencies and some cards that earn them:

- American Express Membership Rewards: The Platinum Card by American Express, the American Express Gold Card, the American Express Green Card.

- Chase Ultimate Rewards: the Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, Chase Ink Business Preferred® Credit Card.

- Bilt Rewards: Bilt Mastercard®.

- Capital One miles: All Capital One Venture cards.

- Citi ThankYou Rewards: Citi Premier® Card.

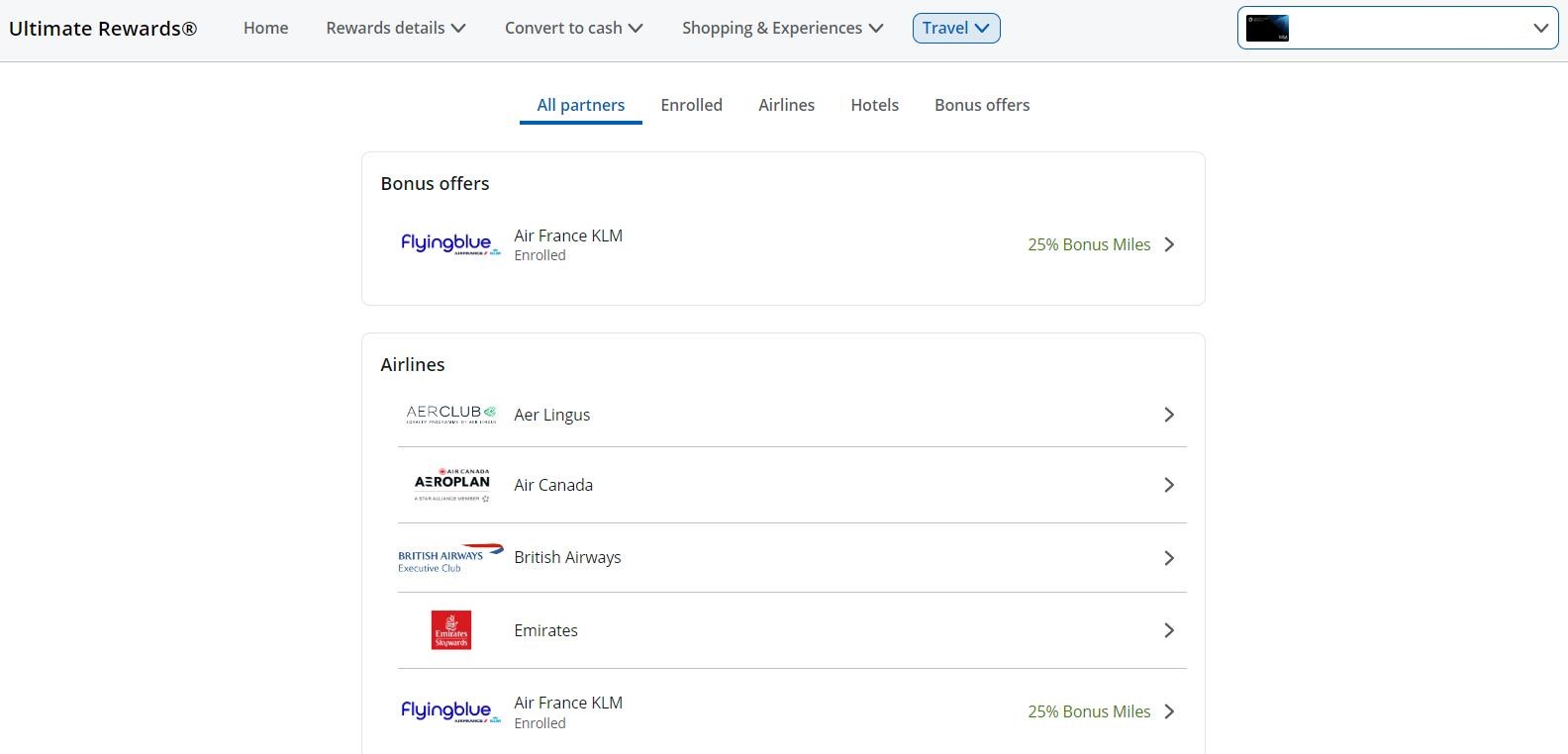

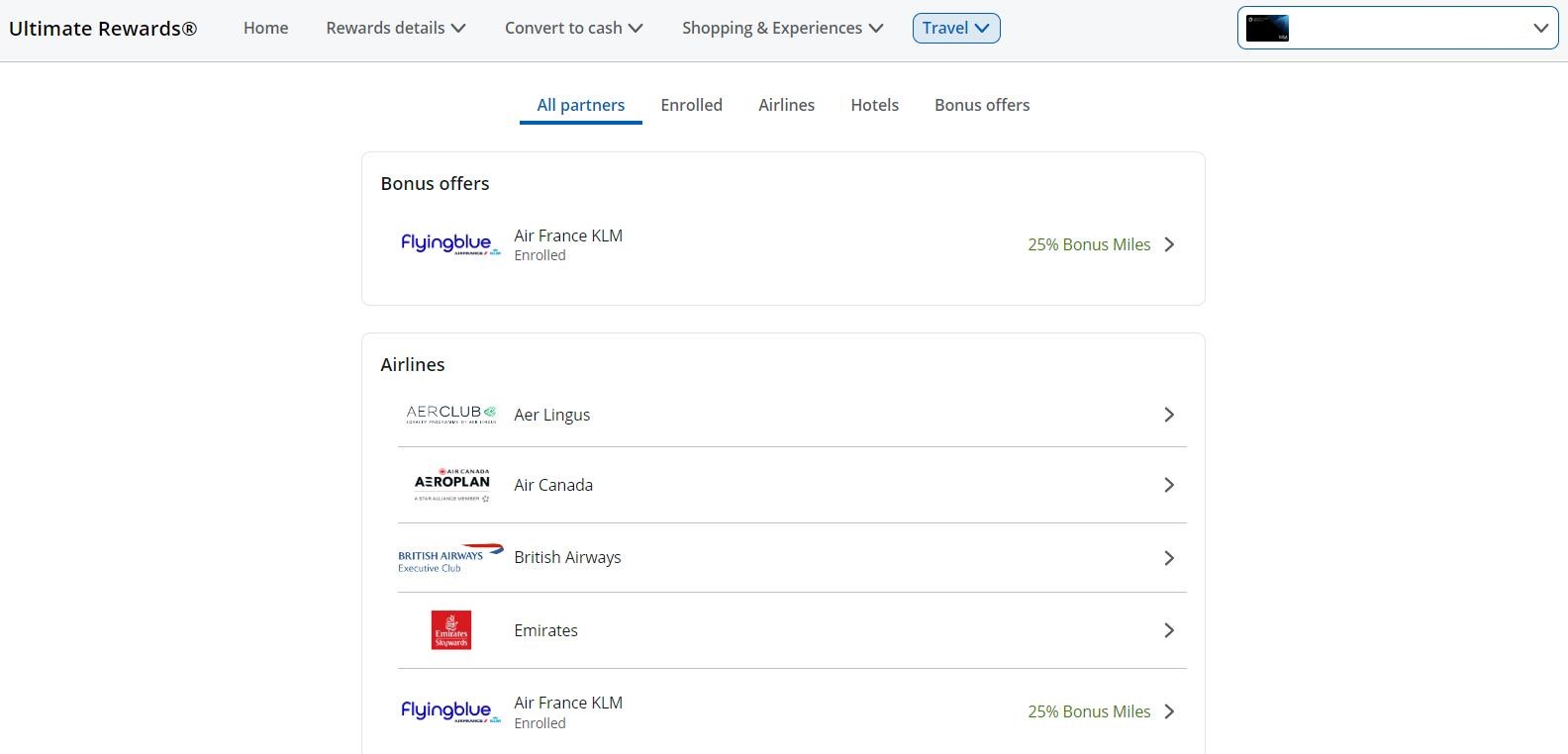

Each transferable currency has different travel partners (many overlap). Here are some of Chase’s travel partners, listed at the Chase TravelSM site:

While the actual value you can get varies greatly based on the flight or hotel, a good benchmark is The Points Guy’s monthly valuation chart, which values most transferable currencies at over 2 cents per point when used as transferable points. That’s double what you’ll get on travel portals, and often you can get much more.

That’s because when transferring your points, you can also take advantage of transfer bonuses offered by credit cards and flash deals (such as Air France-KLM Flying Blue promo awards, which are monthly deals on award flights). These can be incredible deals, up to a 50% discount!

While finding award availability directly with airlines can seem overwhelming, the good news is that tools like Point.me (an award flight search tool) make it easier than ever.

Generally speaking, I always transfer my points. Doing so provides the best value and booking direct ensures that there is no third-party involved should there be an issue with my flight. Moreover, it takes a lot fewer points for a redemption this way. Let me tell you why in the next section.

Comparing Partners vs Portals: Which One Is Best for You?

Unless there is a super cheap flight or room (less than $150 USD), I always transfer points to travel partners, especially when booking business-class flights or nicer hotel rooms. You just get more bang for your buck.

For example, a business class flight from New York to Paris in peak season is 88,000 points on United each way (both Chase Ultimate Rewards and Bilt Rewards transfer to United). Those flights usually cost about $2,400 (though they can get as high as $5,000). If you had the Chase Sapphire Preferred or Bilt Rewards Card and booked through their respective portals, you would need 192,000 points (each point is worth 1.25 cents in either of these portals). That’s over double what you’d need when transferring your points to United booking directly.

Since most flight redemptions for economy start at 20,000 points (when transferring directly to airlines), you need to find a flight that’s less than $250 for it to be worth it to use the portal. This is when using the Chase Sapphire cards or the Bilt card, which offer you more than 1 cent per point when booking via their portals. For Amex or Capital One cards, you only get 1 cent per point/mile. That means you’d need to find a flight for $200 or less for it to make sense to use their portals.

For hotels and rental cars, it’s a little less black and white because you don’t always have transfer partners.

For example, I am booking hotels via the Chase Travel portal on an upcoming trip to Barcelona because there are no rooms bookable with points available. (You can only transfer points from credit cards to chains like Hyatt or Marriott.) Since hotels are $300 and up per night, I’m just using my points to save me money by booking with a non-chain hotel. I wouldn’t be able to book with points otherwise. This is the exception to the rule.

Here are some other cases in which using the portal is your best option:

- There are no award seats available on your desired flight (such as if you’re flying in peak season or during the holidays) or hotel (such as if you want to book a boutique hotel that is not bookable with points).

- You’re booking a rental car and want to use points (you can’t book rental cars directly via points).

- You’re chasing airline status and want to earn points on your booking.

- You simply won’t use your points otherwise.

About that last item: always consider your travel goals and determine whether the ease and convenience of using the portal is worth it to you. Using your points, regardless of how, is better than letting them sit around! Never stockpile your points. They get devalued all the time. So use them rather than lose them!

Travel portals can be an enticing way to use your points. They’re convenient, and banks give you incentives to use them. If you’re new to points and miles and just want a simple way to cash in your earnings, they are definitely an option.

However, you can usually get much better value out of your points by transferring them directly to airlines or hotels. The fewer points you use per trip, the more points you have for more travel (or more points to fly/stay in luxury).

But the great thing is that you don’t have to choose either the portal or transferring to partners. You can mix and match depending on the best option at the time. So do a quick comparison and use points to book your next trip!

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.

Advertiser Disclosure: “Nomadic Matt has partnered with CardRatings for our coverage of credit card products. Some or all of the card offers on this page are from advertisers and compensation may impact how and where card products appear on the site. Nomadic Matt and CardRatings may receive a commission from card issuers.”

Editorial Disclosure: “Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed, or approved by any of these entities. This page does not include all card companies or all available card offers.”

For rates and fees of the Marriott Bonvoy Bevy™ American Express® Card, See Rates and Fees.

For rates and fees of the Delta SkyMiles(R) Gold American Express Card, See Rates and Fees.