Taxpayers face 137 school referendum questions across Wisconsin on Nov. 5 | Wisconsin

(The Center Square) – On Nov. 5, there will be 137 school referendum questions combined for local school districts across the state of Wisconsin.

Those include 57 for a temporary increase in the district’s taxing limit and 22 will ask for a permanent increase, according to the Wisconsin Association of School Boards. Those include two referendums asking for $600 million in additional funding in Madison and a $124.4 million ask in Wauwatosa.

The referendums have piled up since a 1993 Wisconsin law placing revenue limits on school districts.

Since then, 356 of the state’s 434 school districts have put forward a combined 1,500 operating referendum questions with 58% approved, according to Forward Analytics.

This spring alone, voters approved 62 of 103 school referendum questions in the state, a 60.2% approval rate that was the lowest in a midterm or presidential election year since 2010, according to Wisconsin Policy Forum.

The approved referendum allows for up to $534.2 million in new borrowing, $199.6 million in temporary increases to school budgets and $293.3 million in permanent increases to annual budgets, according to the policy forum.

In 2023, voters approved 55.4% of school referendum questions in the state.

State law caps the combined amount each district can receive from state general school aids and the local property tax with adjustments allowed based upon enrollment numbers.

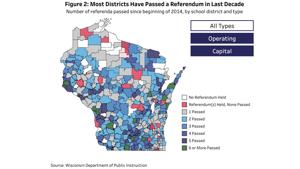

There were 166 school referendum questions in 2022 with 82 in the spring. Since 2014, voters have approved a combined 881 referendums for schools in the state, according to the policy forum.

Because of the limits, school districts with declining enrollment have been more likely to go to referenda and have it approved, Forward Analytics wrote.

“There are no easy answers,” Forward Analytics Director Dale Knapp said in the report. “I don’t think the lawmakers who created this law envisioned referenda being relied on this much. Maybe the answer after 30 years of the limits is an in-depth review of the law to see how it can be improved to continue protecting taxpayers and ensure adequate funding of our schools.”

Source link