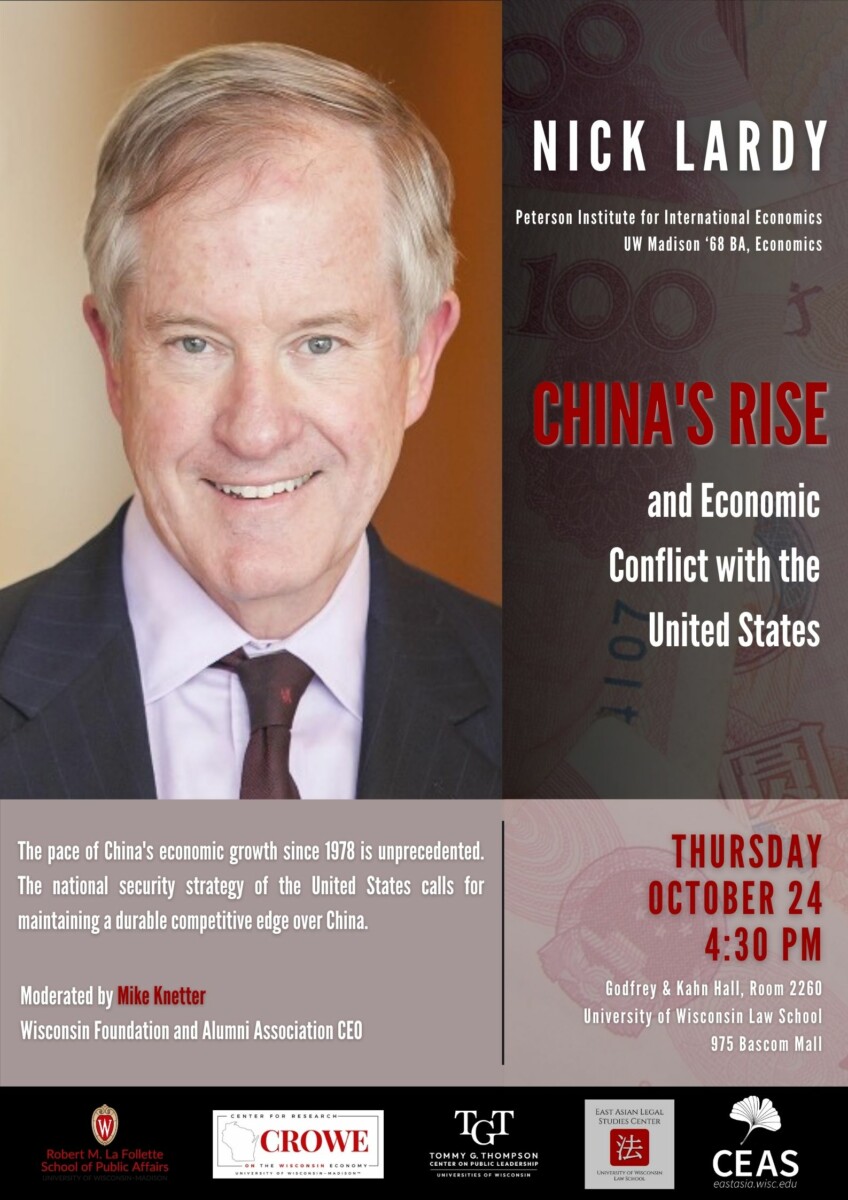

Nick Lardy on China’s Rise and Economic Conflict with the US

This Thursday 4:30 CT at UW:

Description:

The pace of China’s economic growth since 1978 is unprecedented. The national security strategy of the United States calls for maintaining a durable competitive edge over China.

While US officials now like to characterize the goal of economic policy toward China as derisking, the proliferation of tariffs on Chinese goods and an ever widening net of export controls suggests the mix is evolving toward decoupling. The costs and risks of this strategy for the United States are likely to be substantial. China is a large market for many leading US technology firms. If sales of these firms are increasingly curtailed by export controls, how will these firms sustain the R&D expenditures required to sustain their technological lead? More generally what are the implications if the United States curtails economic exchange with what remains the world’s fastest growing large economy?

Biography:

Nicholas R. Lardy, called “everybody’s guru on China” by the National Journal, is a nonresident senior fellow at the Peterson Institute for International Economics. He joined the Institute in March 2003 from the Brookings Institution, where he was a senior fellow from 1995 until 2003. He was the director of the Henry M. Jackson School of International Studies at the University of Washington from 1991 to 1995. From 1997 through the spring of 2000, he was also the Frederick Frank Adjunct Professor of International Trade and Finance at the Yale University School of Management. He is author, coauthor, or editor of numerous books, including The State Strikes Back: The End of Economic Reforms in China? (2019), Markets over Mao: The Rise of Private Business in China (2014), Sustaining China’s Economic Growth after the Global Financial Crisis (2012), The Future of China’s Exchange Rate Policy (2009), China’s Rise: Challenges and Opportunities (2008), Debating China’s Exchange Rate Policy (2008), and China: The Balance Sheet—What the World Needs to Know Now about the Emerging Superpower (2006). Lardy is a member of the Council on Foreign Relations and of the editorial boards of Asia Policy and the China Review.

University of Wisconsin-Madison sponsors of this event:

- Center for East Asian Studies

- Center for Research on the Wisconsin Economy

- East Asian Legal Studies Center

- Robert M. La Follette School of Public Affairs

- Tommy G. Thompson Center on Public Leadership

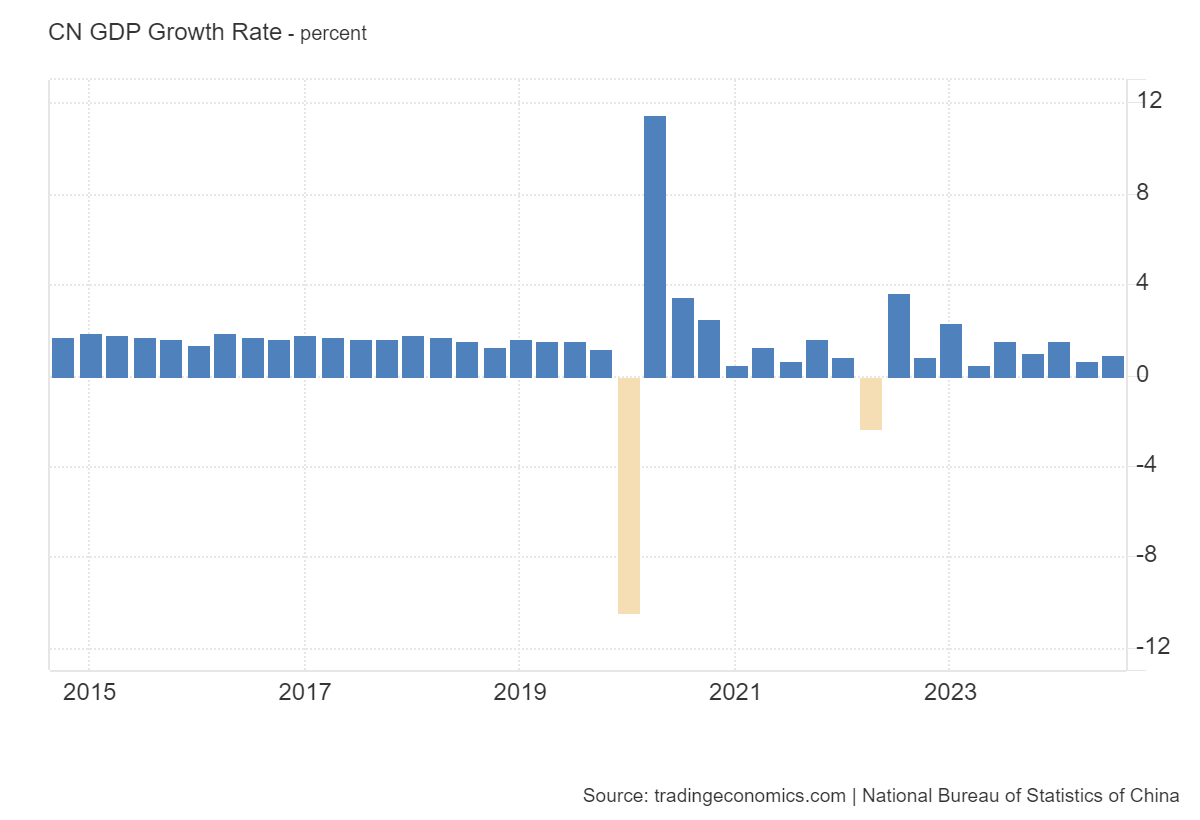

China GDP growth through Q3:

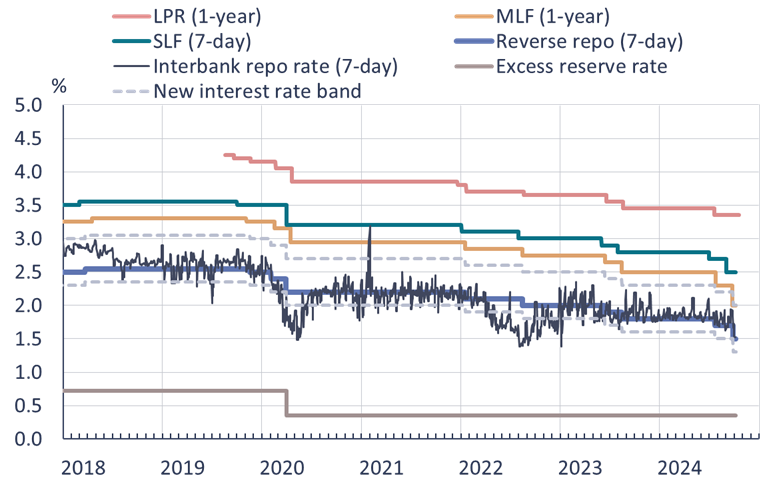

BOFIT reviews the recent stimulus measures:

My impression is that the failure of the CCP to roll out greater fiscal stimulus means that one shouldn’t expect a big cyclical rebound (and certainly none of the measures announced or even contemplated the factors affecting the secular trend, including increasingly statist policies in pursuit of other goals). To wit, from Natixis today:

• Two major developments have followed the Third Plenum in July. First, a series of economic data releases indicated that the plenum had done nothing to improve the country’s short-term outlook. Second, a series of stimulus measures were announced over a two-week period, that have so far failed to reinvigorate the economy.

• The government is unlikely to enact the reforms necessary to support consumption due to high public debt and limited fiscal capacity, as doing so would require cutting subsidies central to the country’s industrial policy. This would contradict Xi Jinping’s focus on innovation.

• The People’s Bank of China may need to continue interventions in both the sovereign bond market and the stock market, though this could reduce foreign investor interest in Chinese financial markets.

• The government’s stimulus measures so far have largely been aimed at stabilizing asset prices rather than addressing the deeper issues of demand and overcapacity.

I don’t think Lardy necessarily agrees with this viewpoint (nor the lagging consumption story in general), which is why it’s a good idea to listen!

Source link