Epic dominates the marketplace – Isthmus

Brendan Keeler, a close observer of health technology, doesn’t hesitate when asked how Epic Systems is faring. “They’re doing great. They’re kicking ass,” he says of Dane County’s top tech company and the nation’s leader in medical software.

Epic is plateauing in terms of capturing new health systems, he says, but continues to outperform its main competitor, Oracle Health (formerly Cerner).

Consider the data reported in Becker’s Health IT newsletter: Between 2017 and 2022, #2 Oracle added 99 new hospital clients but lost almost 8,000 beds in the churn of hospital losses and gains, while #1 Epic signed up 434 new hospitals and added almost 95,000 new beds.

More to the point on Epic’s primacy: All 22 hospitals on U.S. News & World Report’s Best Hospitals Honor Roll use Epic as their electronic health records purveyor.

“Epic’s next phase of big growth is utilizing its dominant market share of in-patient health systems to sell to ancillary health players,” says Keeler, a Portland tech exec and Epic alumnus who blogs at Health API Guy.

He cautions that Epic has grown so big and so powerful that it needs to be mindful of antitrust issues. And then, on a different front, there is a surprising question about MyChart, Epic’s popular patient app.

Epic’s future ambitions were the big topic for its annual client conference, held in August as usual at the company’s fantasy-inspired headquarters on 1,700 acres in the rolling hills of Verona. Some 7,000 Epic clients from all 50 states and 16 foreign countries turned out to hear Epic founder and CEO Judith Faulkner and her team report on what’s new with the little tech company she started in 1979 with a handful of part-time programmers.

No longer just a medical records company, Epic is busy diversifying its business as Keeler suggests. Epic now works with medical device manufacturers, speciality laboratories and health insurers.

Just as telling of Epic’s ambitions, the company is pushing ahead to develop Cosmos, a huge anonymized database of 13 billion Epic patient-clinician encounters that is proving a boon for medical researchers and in some cases a life-saver for patients.

As for that other celebrated gamechanger rocking the health-tech firmament, Epic is all in with Artificial Intelligence. More than 100 AI projects are in use or in development, Faulkner told a buzzy crowd of 11,000 or so at Deep Space, Epic’s five-story underground auditorium.

“If you think we’ve done a lot of creative things in the last year, hold on to your hat. You ain’t seen nothing yet!” Faulkner said.

These successes have certainly paid off for Epic. The company, which has 14,000 employees worldwide, reported revenue of $4.9 billion in 2023, up from $3.2 billion in 2019. Several local health care observers say the new product lines have been especially lucrative.

“They are making money every which way,” one of them marveled.

Epic objected to the characterization, saying in a written comment that the company had expanded the connectivity of healthcare providers to simplify their work, “not to open new revenue streams.”

What’s not in dispute is how costly EHR systems can be and simultaneously how integral they are to running something as complicated as a modern day healthcare system. Becker’s reports that an especially challenging Epic installation for University Hospitals in Cleveland cost $400 million. AdventHealth in Florida paid $355 million for its Epic software.

Epic did not respond to written questions about antitrust allegations. The concern arose early this year when Forbes published two lengthy stories that stop just short of concluding that Epic operates like a monopolist enterprise. The fact that it is the dominant choice for the biggest and most profitable hospital systems has arguably choked EHR competition, wrote author Seth Joseph, who seems to have a divided mind about Epic.

Though an Epic critic, he praised the company for the “incredible progress and innovation [it] has brought to healthcare.”

Keeler comes at the antitrust issue from a steely business perspective. He sees “network effects” (the value of a product increasing exponentially the more people use it) and “moats” (embedded product competitive advantages) as the secret powers that advantage giant tech companies like Epic.

Getting a measure of the antitrust issue is tricky. Federal courts have not been receptive to challenges to the corporate order. “These monopoly cases are very costly and time-consuming,” notes Peter Carstensen, a UW-Madison law school emeritus professor who specializes in antitrust. “That is why unless Epic does something really egregious, I would not expect to see much government action until some of the current big-ticket cases are resolved.”

Still, Carstensen believes there is definitely “a risk” of an antitrust lawsuit in the Epic matter. Keeler agrees, and points out Epic leadership has shown itself to be well lawyered and willing to fight it out in court to defend its rights.

“They’re smart, and my guess is that they will handle it properly,” he says of the antitrust concerns, “but their risk is still there.”

On another legal front, employers like Epic scored a recent victory when a federal court in Texas struck down a Federal Trade Commission ban on non-compete clauses. Epic’s employment contracts routinely restrict former employers from taking certain healthcare jobs for one to two years after leaving the company. The nationwide ban was to have taken effect Sept. 4.

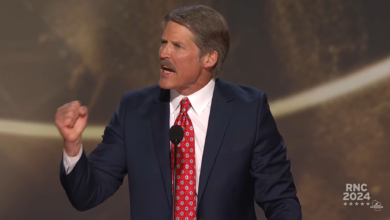

Epic President Carl Dvorak’s talk at the conference was short, low key, and filled with insight on organizational dynamics. Especially on how groups succeed in creating change and how they fail at sustaining it. His takeaway? The Epic hospital network has a real challenge to address with improving the digital patient experience. Just as clinicians grew frustrated with it, he said, so have patients.

And, yes, MyChart, Epic’s popular patient portal, dominates the rankings as best in class. “We’re all very proud of that,” Dvorak said of the rating, “but it’s trending downward.”

“It’s just not good enough. We need to rethink it.” He said this twice.

This was a sobering comment, but perhaps just what you would expect from a company that is almost always one step ahead of the competition.

Epic in profile

• 2,900 hospitals

• 14,000 employees

• 65,000 clinics

• 545,000 staffed beds

• 570,000 physicians

• 280 million U.S. patients

• 325 million worldwide patients

• 7 of the 7 largest health plans

• 20 of the 20 top ranked hospitals

• $4.9 billion revenue 2023

Source: Epic Systems