“Non-Essential Business Cycles” and Implications for the Imminent Recession Call

From a paper by Michele Andreolli, Natalie S. Rickard, and Paolo Surico (presented at NBER Summer Institute Monetary Economics sessions):

Using newly constructed time series of consumption, prices and earnings in essential and non-essential sectors, we document three main empirical regularities on post-WWII U.S. data: (i) spending on non-essentials is more sensitive to the business-cycle than spending on essentials; (ii) earnings in non-essential sectors are more cyclical than in essential sectors; (iii) low-earners are more likely to work in non-essential industries. We develop and estimate a structural model with non-homothetic preferences over two expenditure goods, hand-to-mouth consumers and heterogeneity in labour productivity that is consistent with these findings. We use the model to revisit the transmission of monetary policy and find that the interaction of cyclical product demand composition and cyclical labour demand composition greatly amplifies business-cycle fluctuations.

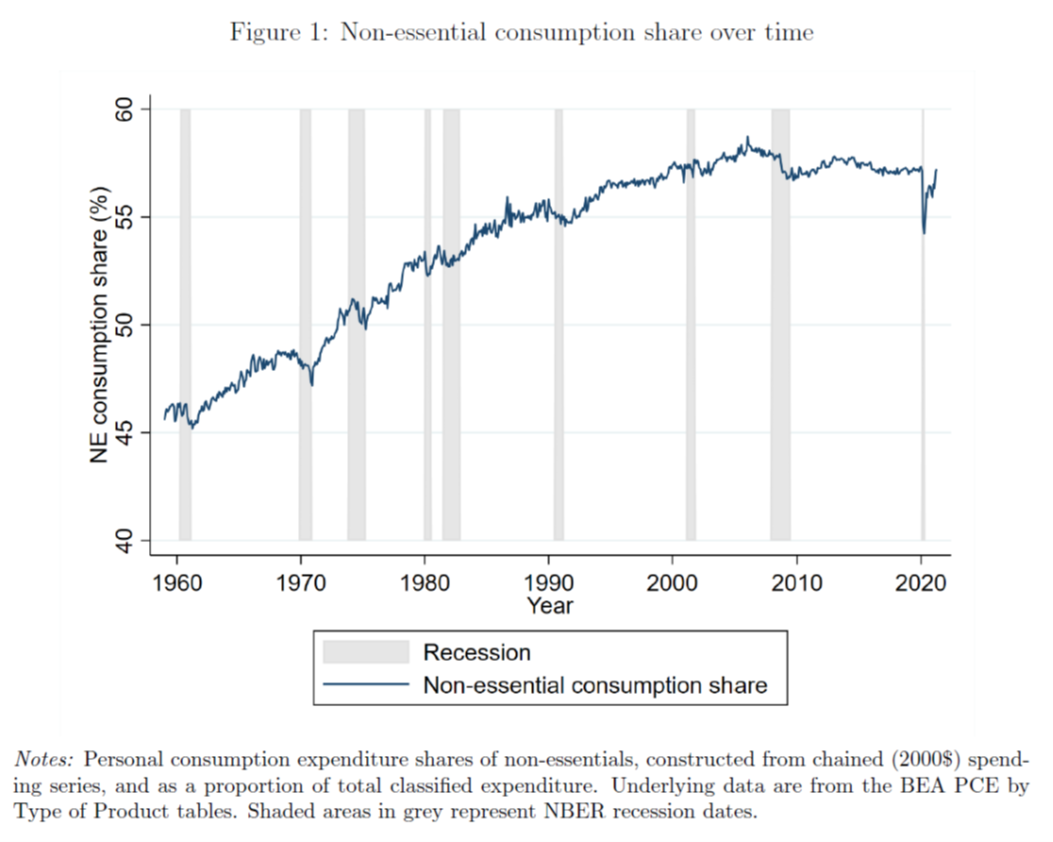

Here are two key pictures.

Source: Andreolli et al (2024).

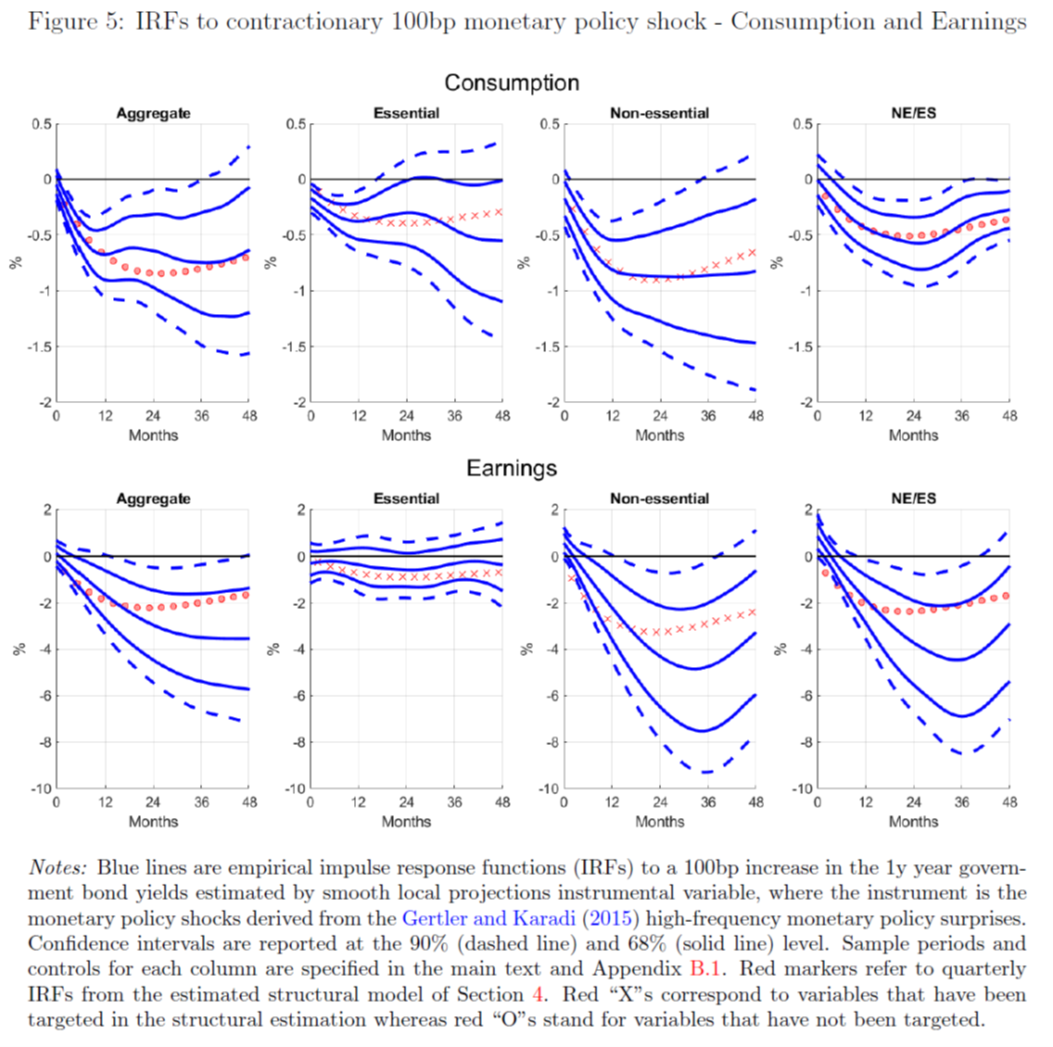

Note that the non-essential share was decreasing before the pandemic (even as consumption overall was rising). Impulse responses functions for a 100 bp monetary shock show that disaggregation is important in seeing what portions of consumption (and hence the aggregate economy) respond.

Source: Andreolli et al (2024).

What’s a non-essential? The authors define items with demand elasticities greater than one (in absolute value) as non-essential. Some obvious items: food away from home, entertainment, public transit.

The implication: Non-essentials respond much more strongly the contractionary monetary policy than do essentials. That means catching early the contractionary effects of monetary policy requires looking at consumption at a disaggregate level, and preferably at higher frequency than the usual monthly series. What do these indicators look like?

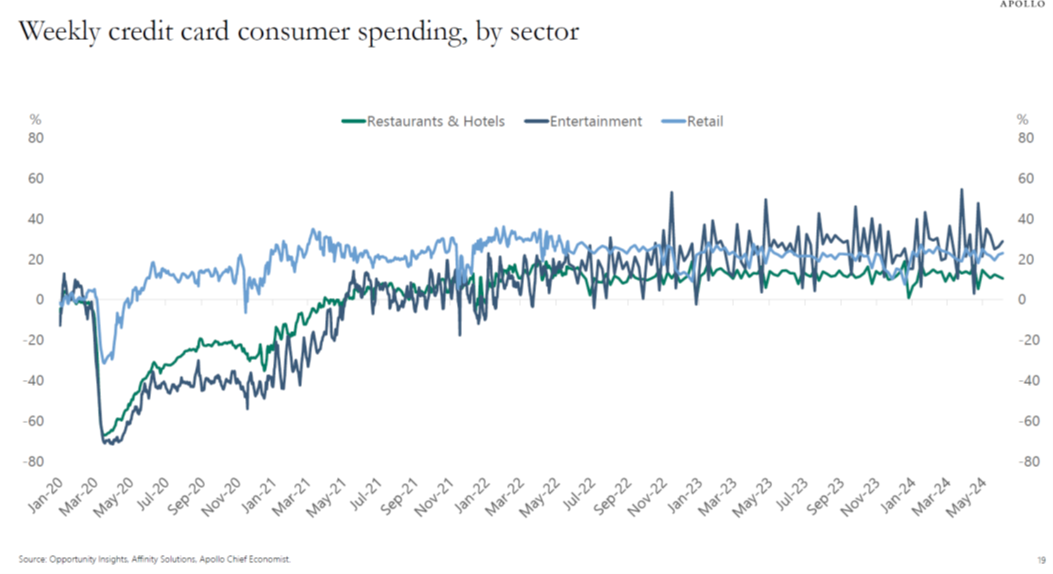

Here’s credit card expenditure growth, courtesy of Torsten Slok et al. Restaurants and hotels (proxy for pleasure travel) and entertainment are still growing, even keeping in mind inflation.

Source: Slok, Shah, Galwankar, “Daily and weekly indicators for the US economy,” Apollo, 17 August 2024.

From Slok’s communication today, regarding these non-essential higher frequency indicators:

Looking at the latest daily and weekly data shows that … restaurant bookings are strong, air travel is strong, hotel occupancy rates are high, … and Broadway show attendance and box office grosses are strong. …The bottom line is that there are no signs of a recession in the incoming data…

This is contra Michaillat-Saez based on monthly data through July, discussed in this post, as well as individuals in this list.

Source link